However, if the answer is "no" to even one of these conditions, that means it's time to break out the balance sheets and fill out Schedule L.įor your assets, you will need to account for all cash and cash equivalents, accounts receivable, inventories, investments, land and loans made to other individuals or businesses.

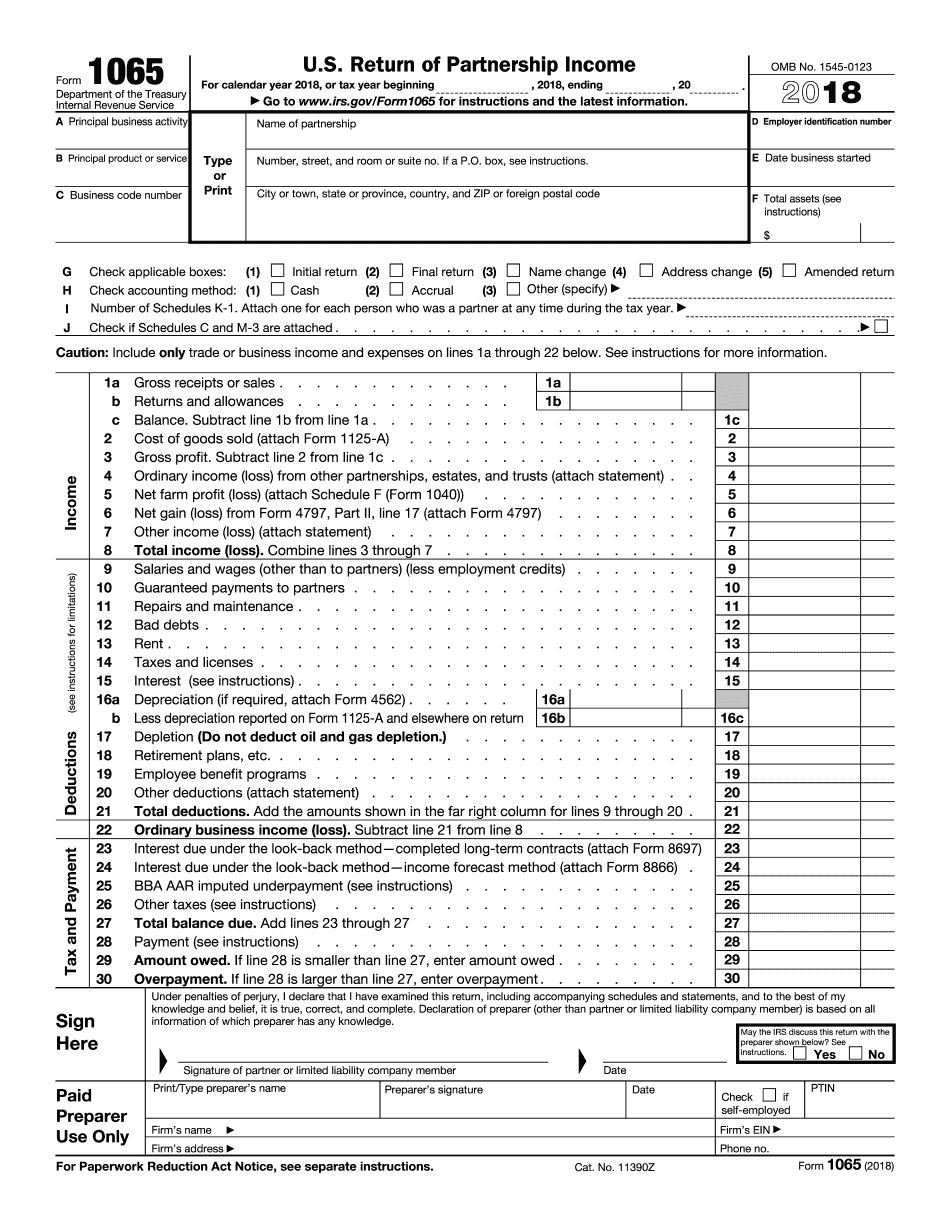

If you can answer "yes" to ALL of these four questions, then you don't have to file Schedule L. In terms of filing Form 1065, Schedule M-3 is required when a partnership has total assets of more than $10 million, has total receipts of more than $35 million or owns at least a 50% share of another partnership that is itself required to file an M-3. Not filing Schedule M-3: Is your partnership not filing and not required to file Schedule M-3? Schedule M-3 is used for net income reconciliation.Timely filing of Schedule K-1: Are you filing Schedule K-1 with the return, and did your partnership furnish K-1s to all its partners on or before the due date for the partnership's return (including any extensions)?.

Total assets: Did your partnership's assets at the end of the year total less than $1 million?.Total receipts: Did your partnership have less than $250,000 in gross receipts during the year?.Schedule L is not required for all partnerships you only have to file it if you don't meet certain conditions.

The first thing to do when looking at filling out Schedule L is to determine whether you have to complete it in the first place.

0 kommentar(er)

0 kommentar(er)